So, I’m in the dental chair getting my teeth cleaned at my new dental office.

I’m a creature of habit and super loyal, so even though I haven’t lived in Walnut Creek for 9 years, I was still going to my dentist in Danville. But in my efforts to simplify my life, I decided to finally get a local dentist.

My new hygienist (who I love already) and I started having a pleasant conversation…basically getting to know each other. We start talking about pastimes and I mention my new blog. She tells me about the care her mother (or maybe step-mother) had received and how wonderful it was. Her mother also had dementia and the home she lived at provided Memory Care and other resources. And then she said it cost $10,000 a month. Yep, 5 digits!!!

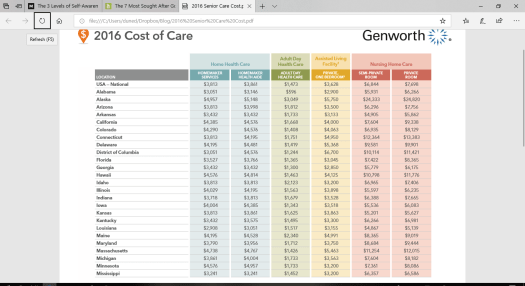

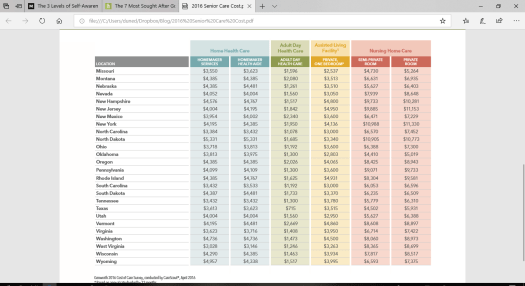

Obviously, costs vary depending on the type of facility, as well as city to city, county to county and state to state. The facility in Vallejo that Dad is at currently, is $3500 per month for a shared room in an assisted living/nursing home hybrid. At one point, I was researching facilities for Dad closer to me, in Marin County. Marin County is definitely going to be on the high side and I received quotes of a minimum of $5500-$7500 for a shared room in a nursing home. Woof! I also inquired in the next town over from Vallejo, Benicia, where I was quoted $6000 a month, on average…minimum.

Some of you may be thinking $3500 is a steal and can I get the number to this facility?

Well, that is no longer the minimum cost because Dad’s facility is now under new ownership. They grandfathered in the current residents at their current price, but the new price is around $5000 minimum.

Why do I keep highlighting the word ‘minimum’?

Because $5000 is for a shared room, all meals, room cleaning, laundry, activities, and medicine distribution. Luckily, Dad can care for himself in most ways still. He can still use the bathroom and shower on his own. He can take his meds and eat without assistance. He is mobile and his disposition is agreeable and pleasant. This is important because if he needed help in any of these areas, there would be additional costs. And since none of his conditions (dementia and heart failure) are curable, he will eventually need these additional aids.

When Dad was recovering at Windsor, I found out that they were also a Skilled Nursing Home and not just a rehab center. Their monthly costs were about $7000. Before Dad went into Windsor, I researched In-home care at his apartment and that ran $20 to $30 per hour. For the amount of care and help Dad needs, it would cost about the same as Windsor. Dad needs around the clock monitoring because he isn’t always stable on his feet and has fallen several times, and with his memory, we couldn’t risk him trying to cook and leaving on the stove.

Dad didn’t plan for living in a Nursing Home or Assisted-Living, financially or otherwise. Neither do a lot of people. I certainly didn’t before this. And even if people do think it’s a possibility, they don’t actually understand the full cost. For all-inclusive care, costs can be as high $8000 to $12000 a month.

What if a couple needs care together? $$$$$$$$$$

So now that you’ve read this, you must ask yourself, have your parents prepared for these costs? Have you for them or yourself?

I think most people believe they will die in their sleep and in the comfort of their own home. In reality, a person can need care for years. But, even one year of care can drain a family’s finances. My grandmother that had dementia, was healthy in most other ways. She lived with my Aunt and her family for more than 5 years and was fortunate enough to have them look after her. Not everyone is as fortunate. Not everyone has children. Not everyone has children that are stable enough to take on the care of another person or persons. Not everyone has a dual income or dual income retirement. Tex and I have 2 children and the last thing we want them to have to deal with is how to take care of us or figure out funding for our care.

So we plan…

401K’s, Pensions, Long-term care insurance, Social Security…we plan and save and we still may not be able to afford a nursing home for both of us if the need arose. Most people wouldn’t.

For a while now, Tex and I were planning on buying a smaller house when he retires. A 2 bedroom, 1 and a half bath seemed ideal because it would fit in with our simpler, clutter-free lifestyle. But lately I’ve been thinking of getting a 3 bedroom with 2 bathrooms. So that when the time comes and Tex and/or I need help, we can hire a live-in nurse. They would have free rent, utilities, most food and a salary of some sort. Even with the cost of assistance on their days off, we should still be able to live comfortably. It’s just an idea for now and we will continue to look at all options.

What happens if a person doesn’t have the funding or a loved one to care for them? Doesn’t Medicare kick in?

Admittedly, I’m not well-versed in this area but my understanding is that Medicare only kicks for the first 100 days and after that, Medicaid kicks in, but not without out of pocket costs. So, if you are talking about a parent, then it may be expected to drain all of their savings first and their assets, such as a house, sold. They have to be broke. And they may not have a choice of facilities. And even then, there may still be costs.

So plan and if you have parents, ask them about their plans.

“Well, it’s okay if they take all of my parents’ money. I wasn’t expecting an inheritance anyway.”

LOL…I’m just going to drop this link here: https://www.medicalalertadvice.com/articles/does-state-law-require-you-to-support-your-aging-parent/

Yep, if a nursing home doesn’t get paid, they can sue the children in many states. I’m looking at you, my fellow Californians.

So for F’s sake, plan!!! And find out your parents’ plans, while you are at it!!!

I would definitely love to hear back on this topic. For those you with plans in place, any ideas outside of the ones mentioned? Let’s spread the word.